Introduction: The Changing Face of Auto Protection

As we navigate through the final weeks of 2025 and look toward the horizon of 2026, the world of automotive insurance is undergoing its most significant transformation since the invention of the seatbelt. For decades, the choice between third-party and comprehensive coverage was a simple matter of budget versus luxury. However, the rise of advanced driver assistance systems, the massive shift toward electrification, and the integration of artificial intelligence into the claims process have fundamentally altered the value proposition of every policy.

- Introduction: The Changing Face of Auto Protection

- Why 2026 Demands a New Perspective on Insurance

- Understanding Third-Party Car Insurance (Liability Only)

- Exploring Comprehensive Car Insurance (Full Coverage)

- Beyond the Basics: The Shield Against the Unexpected

- Collision vs Comprehensive: Knowing the Difference

- Add-ons and Riders for 2026

- Third-Party vs Comprehensive: A Direct Comparison for 2026

- The Factors Influencing Insurance Premiums in 2026

- The Rise of Artificial Intelligence in Claims

- Electric Vehicles and the Battery Replacement Dilemma

- Climate Change and Natural Disaster Projections

- Live Data: Average Car Insurance Rates in December 2025 and 2026 Forecasts

- How Telematics and Usage-Based Insurance are Redefining Coverage

- Is 2026 the Year to Switch Your Policy?

- Strategic Tips to Lower Your Premiums in 2026

- Conclusion: Navigating the 2026 Insurance Landscape

In 2026, a car insurance policy is no longer just a legal document you keep in your glove box. It is a dynamic, data driven agreement that interacts with your vehicle’s software and your personal driving habits. Whether you are driving a legacy internal combustion engine vehicle or a cutting edge electric SUV, understanding the nuances between basic liability and full protection is essential for your financial health. This guide provides a deep dive into the 2026 insurance landscape, backed by live data and expert projections to help you make an informed decision.

Why 2026 Demands a New Perspective on Insurance

The economic environment of 2026 presents unique challenges for motorists. Inflation, while stabilizing in some sectors, remains a persistent factor in automotive repair costs. Modern vehicles are equipped with sophisticated sensors, cameras, and lidar systems. What used to be a simple fender bender now involves the recalibration of multiple computer systems, often pushing repair bills into the thousands of dollars.

Furthermore, the frequency of extreme weather events has increased. Hailstorms, flash floods, and wildfires are no longer “once in a century” occurrences. They are seasonal realities that can destroy a vehicle in minutes. In this context, the “cheapest” insurance option might actually be the most expensive if it leaves you holding a bill for a total loss.

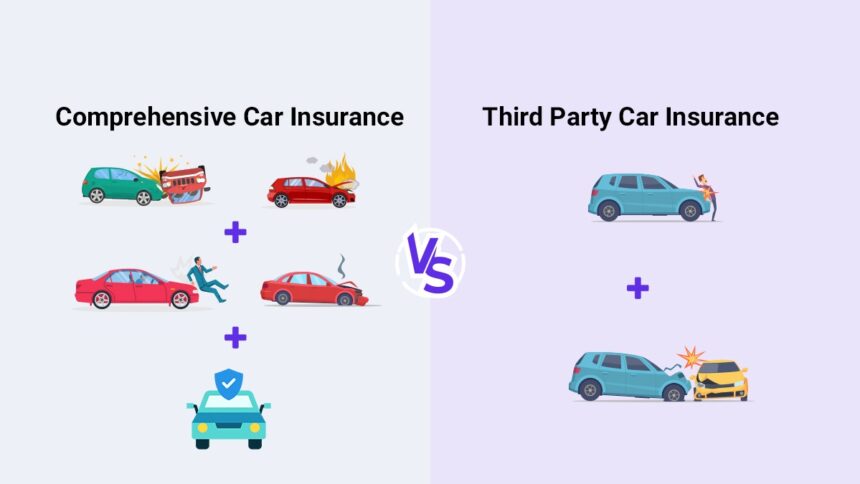

Understanding Third-Party Car Insurance (Liability Only)

Third-party car insurance remains the bedrock of automotive law in almost every jurisdiction. It is designed to protect the public, not the policyholder. In 2026, while the fundamental purpose hasn’t changed, the limits and costs associated with it have.

The Legal Requirement

Third-party insurance is the minimum level of cover required by law. It ensures that if you are at fault in an accident, any damage you cause to other people’s property or any injuries sustained by others are covered. Without this, you cannot legally operate a vehicle on public roads.

What is Covered?

In 2026, third-party policies primarily focus on three areas:

- Damage to other vehicles: If you rear end another car, your insurer pays for their repairs.

- Property damage: This includes damage to fences, lamp posts, or even buildings.

- Personal injury to others: This covers the medical expenses and legal costs associated with injuries to passengers in your car, people in other vehicles, or pedestrians.

What is Excluded?

The most critical thing to remember is that third-party insurance provides zero protection for your own assets.

- Your vehicle repairs: If you cause a crash, you pay for your own repairs out of pocket.

- Theft and Vandalism: If your car is stolen or keyed, you get nothing.

- Natural Disasters: Fire, flood, or storm damage is completely excluded.

- Medical expenses for the driver: In many jurisdictions, the at-fault driver’s injuries are not covered under a basic third-party plan.

Exploring Comprehensive Car Insurance (Full Coverage)

Comprehensive car insurance is often referred to as “full coverage,” though it is actually a bundle of different protections. In 2026, this is becoming the preferred choice for a majority of drivers due to the high replacement value of modern cars.

Beyond the Basics: The Shield Against the Unexpected

Comprehensive insurance includes everything found in a third-party policy but adds a massive layer of protection for the policyholder. It covers “non collision” incidents. If a tree falls on your car during a storm in 2026, comprehensive insurance is the only thing standing between you and a total financial loss.

Collision vs Comprehensive: Knowing the Difference

In the 2026 market, “Full Coverage” typically refers to the combination of:

- Liability: For others.

- Collision: Covers damage to your car resulting from a crash with another vehicle or object, regardless of fault.

- Comprehensive: Covers damage from “acts of God,” theft, fire, and vandalism.

Add-ons and Riders for 2026

Modern comprehensive policies now offer specialized riders that were rare five years ago:

- Battery Protection: Specifically for Electric Vehicles (EVs) to cover battery degradation or damage.

- Software Coverage: Protection against cyber attacks or software glitches that might cause a malfunction.

- Key Replacement: With digital keys and biometrics becoming standard, replacing a “key” can now cost upwards of $500.

Third-Party vs Comprehensive: A Direct Comparison for 2026

Choosing between these two options requires a look at the math. In 2026, the price gap has narrowed in some regions but widened in others due to the cost of parts.

Cost vs Value: The Mathematical Reality

As of December 2025, the national average for car insurance in the United States has reached approximately $2,316 annually for full coverage. Minimum third-party coverage averages around $1,548. While that $768 difference seems significant, consider the cost of a modern headlight assembly for a 2024 model car, which can easily exceed $1,200.

If you drive a vehicle worth more than $5,000, third-party insurance is often a poor financial move. One minor error could result in a total loss of your asset, whereas a comprehensive policy would have covered the repair or replacement.

Risk Management and Your Financial Future

In 2026, risk management is about more than just driving safely. It is about protecting against the volatility of the environment. With repair times increasing due to specialized labor shortages, comprehensive policies often include “Loss of Use” or “Rental Reimbursement” benefits. If your car is in the shop for three weeks, a third-party policy leaves you walking or paying for Ubers, while a comprehensive policy provides a loaner vehicle.

The Factors Influencing Insurance Premiums in 2026

Several global and technological trends are driving the insurance rates we see today.

The Rise of Artificial Intelligence in Claims

By early 2026, “touchless claims” have become standard for major insurers. When you have an accident, you simply take photos with your smartphone. AI algorithms analyze the pixel data to estimate damage in seconds. While this speeds up the process, it also means that premiums are being adjusted in real time based on massive datasets of repair costs. Insurers now have a much clearer picture of which cars are expensive to fix, and they price their comprehensive policies accordingly.

Electric Vehicles and the Battery Replacement Dilemma

Electric Vehicles (EVs) present a unique challenge in 2026. While they have fewer moving parts, their batteries are incredibly expensive. A minor floorboard impact can compromise a battery pack, leading to a “write off” of a vehicle that looks perfectly fine on the outside. Because of this, comprehensive insurance for EVs is often 15% to 60% higher than for equivalent gasoline cars. However, without it, an EV owner is taking a massive gamble on a single, expensive component.

Climate Change and Natural Disaster Projections

2026 projections from major analysts like Deloitte and S&P Global suggest that “social inflation” and climate risk are the primary drivers of premium increases. Insurers are paying out more for total losses due to floods and fires. If you live in a high risk zone, a third-party policy is essentially no insurance at all against the most likely threats to your vehicle.

Live Data: Average Car Insurance Rates in December 2025 and 2026 Forecasts

To give you the most accurate picture, here is the state of the market as of late December 2025.

National Averages and State Highlights

The national average for a full coverage policy is currently hovering around $193 per month. However, this varies wildly by location:

- Maryland: One of the most expensive states, with averages exceeding $350 per month for full coverage.

- Vermont: Remains one of the most affordable, with monthly premiums as low as $83.

- Florida and Louisiana: Continue to see high rates due to litigation costs and hurricane risks.

For 2026, analysts at EY predict a further 3% increase in premiums globally. This is driven by “claims inflation,” where the cost of medical care and auto parts continues to outpace general economic inflation.

Top Carriers for 2026

According to recent customer satisfaction and financial strength ratings:

- Liberty Mutual: Known for highly customizable comprehensive plans.

- Nationwide: Noted for its “SmartRide” telematics program which can lower costs for safe drivers.

- Progressive: A leader in AI driven claims processing.

- State Farm: Continues to hold the largest market share with a focus on local agent support.

How Telematics and Usage-Based Insurance are Redefining Coverage

The biggest shift in 2026 is the move away from demographic pricing toward behavioral pricing.

Paying for How You Drive, Not Just Who You Are

In the past, a 22 year old male would always pay more than a 45 year old female. In 2026, telematics changed that. By using a plug in device or a smartphone app, insurers can track:

- Hard braking and rapid acceleration.

- Cornering speeds.

- Time of day (driving at 3:00 AM is higher risk).

- Total mileage.

Drivers who opt into these programs often see a 10% to 30% discount on their comprehensive premiums. This is especially beneficial for those who want the protection of a comprehensive policy but are on a third-party budget.

Is 2026 the Year to Switch Your Policy?

Determining the right time to change your coverage level depends on several specific factors.

Deciding Based on Vehicle Age and Value

The “10% rule” is a classic guide that remains relevant in 2026. If your annual comprehensive premium plus your deductible is more than 10% of your car’s total market value, it might be time to drop down to third-party. However, with the used car market remaining strong and replacement costs high, many drivers are keeping comprehensive coverage on vehicles up to 12 years old.

Deciding Based on Geographic Risk

If you live in an urban area with high rates of vehicle theft or a coastal area prone to flooding, comprehensive insurance is non negotiable. In 2026, the rise in “catalytic converter” and “high voltage cable” thefts has made even older cars targets for thieves.

Strategic Tips to Lower Your Premiums in 2026

You don’t have to sacrifice coverage to save money.

- Increase your deductible: Moving from a $500 to a $1,000 deductible can slash your comprehensive premium significantly.

- Bundle your policies: Combining home and auto insurance remains the most effective way to get a discount.

- Audit your mileage: Many people are still working remotely in 2026. If you drive less than 7,500 miles a year, ensure your insurer knows it.

- Improve your credit score: In many states, your credit history is a major factor in how insurers perceive your risk.

Conclusion: Navigating the 2026 Insurance Landscape

The choice between third-party and comprehensive car insurance in 2026 is a balance between immediate savings and long term security. While third-party insurance satisfies the law, it offers no protection for your vehicle in an increasingly expensive and volatile world. Comprehensive insurance, though more costly, provides the peace of mind necessary in an era of $40,000 average car prices and unpredictable weather patterns.

As you review your policy for the coming year, consider the “total cost of ownership.” If an accident happened tomorrow, could you afford to replace your car? if the answer is no, then the investment in a comprehensive policy is likely the smartest financial decision you will make this year.