Choosing the right health insurance plan for 2026 requires more than just a quick look at monthly premiums. As the medical landscape evolves with new technologies and shifting economic pressures, individual shoppers must stay ahead of the curve to secure the best possible care. This comprehensive guide breaks down the top providers, emerging trends, and strategic advice for the current enrollment season.

- The State of Individual Health Insurance in 2026

- Top 10 Health Insurance Plans for Individuals in 2026

- 1. Kaiser Permanente: Best for Integrated Care and Affordability

- 2. Blue Cross Blue Shield (BCBS): Best for Nationwide PPO Access

- 3. UnitedHealthcare (UHC): Best for Digital Innovation and Self-Employed Individuals

- 4. Anthem: Best for Copay Predictability

- 5. Ambetter Health: Best Value for Marketplace Shoppers

- 6. Oscar Health: Best for User Experience and Technology

- 7. Aetna (CVS Health): Best for Pharmacy Integration

- 8. Cigna Healthcare: Best for Global Professionals and Wellness

- 9. Molina Healthcare: Best for Low-Income Individual Coverage

- 10. Highmark: Best for Regional Expertise

- Understanding Plan Types: HMO, PPO, EPO, and POS

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- Metal Tiers Explained: Finding Your Financial Balance

- Factors Driving Costs in 2026

- Critical Deadlines for 2026 Coverage

- Strategic Tips for Choosing Your 2026 Plan

- 1. Analyze Your 2025 Usage

- 2. Verify Your Doctors

- 3. Check the Drug Formulary

- 4. Consider a Health Savings Account (HSA)

- Future Outlook: Healthcare Beyond 2026

The State of Individual Health Insurance in 2026

As of December 24, 2025, the open enrollment window for 2026 coverage is currently in its peak phase. For most residents in the United States, the deadline to secure a plan starting on January 1 has passed, but the final deadline for February 1 coverage is rapidly approaching on January 15, 2026. This year has seen a significant shift in how insurers structure their benefits, particularly concerning specialist access and digital health integration.

Medical costs are projected to rise by approximately 8.5 percent this year. Several factors contribute to this trend, including the high demand for specialty medications like GLP-1 agonists for weight loss and diabetes, increased labor costs within hospital systems, and the integration of artificial intelligence in diagnostic imaging. Despite these rising costs, the marketplace remains competitive, offering diverse options for those who are self-employed, freelancers, or without employer-sponsored coverage.

Top 10 Health Insurance Plans for Individuals in 2026

When evaluating the best plans for the coming year, we looked at factors such as premium affordability, network breadth, customer satisfaction ratings, and the efficiency of claims processing.

1. Kaiser Permanente: Best for Integrated Care and Affordability

Kaiser Permanente continues to lead the market for individuals who prefer a one-stop-shop approach to healthcare. Unlike traditional insurers, Kaiser acts as both the insurance provider and the healthcare deliverer. This integrated model allows for seamless communication between your primary doctor, specialists, and the pharmacy.

For 2026, Kaiser’s Silver plans remain among the most competitively priced in their service areas. They consistently earn high marks for preventive care and have one of the lowest claim denial rates in the industry. However, keep in mind that you must use Kaiser’s own facilities and doctors for most non-emergency services.

2. Blue Cross Blue Shield (BCBS): Best for Nationwide PPO Access

Blue Cross Blue Shield remains the gold standard for individuals who travel frequently or want the widest possible choice of doctors. With a network that includes over 90 percent of physicians and hospitals across the country, BCBS offers unparalleled flexibility.

Their PPO (Preferred Provider Organization) plans are particularly popular for 2026 because they allow members to see specialists without a referral. While their premiums can be higher than HMO-style competitors, the peace of mind provided by their national reach is often worth the extra cost for families and frequent travelers.

3. UnitedHealthcare (UHC): Best for Digital Innovation and Self-Employed Individuals

UnitedHealthcare has invested heavily in its digital infrastructure for 2026. Their mobile app, myUHC, provides real-time access to virtual visits, claims tracking, and a digital ID card. For self-employed individuals, UHC offers a variety of Choice Plus plans that provide access to a massive national network.

Their 2026 updates include expanded mental health resources and 24/7 access to telehealth at $0 copays on many Silver and Gold tiers. This makes them a top choice for digital nomads and tech-savvy individuals who value convenience.

4. Anthem: Best for Copay Predictability

Operating under the Elevance Health umbrella, Anthem is a powerhouse in several major states. For the 2026 plan year, Anthem has focused on “clear pricing” models. Many of their plans now feature flat copays for a wide range of services, including urgent care and diagnostic labs, before you even hit your deductible.

This transparency is vital for individuals who want to budget their monthly healthcare expenses without fear of surprise bills. Anthem also offers robust wellness rewards programs that can help offset the cost of premiums through healthy activities.

5. Ambetter Health: Best Value for Marketplace Shoppers

Ambetter has grown into one of the largest providers of ACA (Affordable Care Act) plans. They specialize in providing high-value coverage to individuals who qualify for subsidies. In 2026, Ambetter has expanded its “My Health Pays” program, which allows members to earn points for healthy behaviors that can be used to pay for monthly bills or utilities.

While their networks are often more localized (HMO or EPO), they provide a critical service for those looking for the lowest possible monthly premium while maintaining essential health benefits.

6. Oscar Health: Best for User Experience and Technology

Oscar Health continues to disrupt the market with its tech-first philosophy. Their plans are designed for the modern individual who wants to manage everything from their smartphone. For 2026, Oscar has introduced “Care Teams” for every member, consisting of a nurse and a health guide who help navigate the complexities of the healthcare system.

Their “Zero Virtual Care” initiative remains a major draw, offering $0 virtual primary care visits. This is particularly beneficial for healthy individuals who rarely need in-person specialist visits but want the security of professional medical advice at their fingertips.

7. Aetna (CVS Health): Best for Pharmacy Integration

Now fully integrated with CVS Health, Aetna offers unique advantages for individuals who require regular prescriptions. Many Aetna plans for 2026 provide low-cost or $0 copays for prescriptions filled at CVS pharmacy locations.

Furthermore, Aetna members often get discounted access to MinuteClinic services, providing a convenient alternative to the emergency room for minor illnesses. Their 2026 plans are highly rated for chronic condition management, making them a strong contender for those managing long-term health issues.

8. Cigna Healthcare: Best for Global Professionals and Wellness

Cigna is well-known for its focus on whole-person health. In 2026, Cigna has doubled down on mental and emotional well-being benefits. Their plans often include access to the Ginger app for on-demand coaching and therapy.

For individuals who may spend time working abroad, Cigna’s Global plans offer some of the most comprehensive international coverage available. Domestically, their PPO networks are extensive and well-regarded for their customer service.

9. Molina Healthcare: Best for Low-Income Individual Coverage

Molina focuses primarily on providing affordable options for those who might be transitioning between Medicaid and private insurance. For 2026, Molina has simplified its plan structures to make them easier to understand.

Their plans are often high in value, covering essential services with minimal out-of-pocket costs for those who qualify for cost-sharing reductions. They are an excellent choice for individuals who prioritize basic, reliable coverage at the most affordable price point.

10. Highmark: Best for Regional Expertise

Dominating the Pennsylvania, West Virginia, and Delaware markets, Highmark provides a level of regional expertise that national carriers often miss. For 2026, Highmark has partnered with local health systems to offer “community” plans that provide deep discounts if you stay within a specific hospital network.

This regional focus allows for better coordination of care and often results in higher customer satisfaction scores than larger, more fragmented providers.

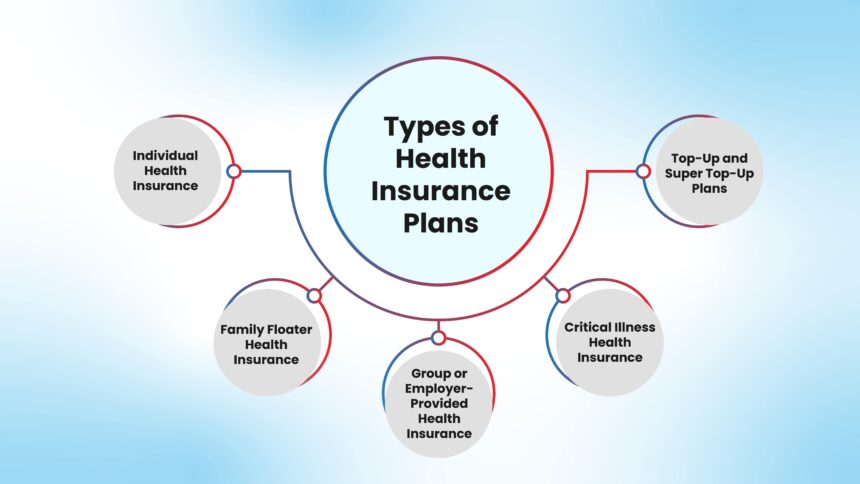

Understanding Plan Types: HMO, PPO, EPO, and POS

Choosing between these acronyms is often the most confusing part of the selection process. Here is a breakdown of how these structures function in 2026.

Health Maintenance Organization (HMO)

HMO plans generally require you to choose a primary care physician (PCP) who acts as a gatekeeper. To see a specialist, you must get a referral from your PCP. These plans are usually the most affordable because the insurer has negotiated lower rates with a specific network of doctors. In 2026, HMOs are increasingly popular among young, healthy individuals who do not mind the extra step of a referral in exchange for lower monthly costs.

Preferred Provider Organization (PPO)

PPO plans offer the most freedom. You do not need a referral to see a specialist, and you can even see doctors outside the network, though your costs will be higher. For 2026, PPO premiums have seen the highest growth rates due to the increasing costs of out-of-network care. However, for individuals with complex medical needs, the flexibility of a PPO is often necessary.

Exclusive Provider Organization (EPO)

EPO plans are a hybrid. Like an HMO, you are generally not covered for out-of-network care except in emergencies. However, like a PPO, you usually do not need a referral to see a specialist within the network. Many tech-forward insurers, like Oscar Health, favor the EPO model because it balances cost control with member convenience.

Point of Service (POS)

POS plans require you to have a PCP and get referrals, but they also allow you to see out-of-network doctors for a higher cost. These plans are becoming rarer in the 2026 market as insurers move toward more defined HMO or PPO structures to manage rising costs.

Metal Tiers Explained: Finding Your Financial Balance

The ACA categorizes plans into four “metal” tiers based on how you and the insurance company share costs.

Bronze Plans

Bronze plans have the lowest monthly premiums but the highest out-of-pocket costs when you receive care. These are best for individuals who are generally healthy and only want protection against a major medical catastrophe. In 2026, many Bronze plans have deductibles exceeding $7,000 for individuals.

Silver Plans

Silver plans represent the “benchmark” in the marketplace. They offer a moderate balance between premiums and out-of-pocket costs. Crucially, if you qualify for cost-sharing reductions based on your income, you must choose a Silver plan to receive those extra savings. This makes Silver the most popular tier for 2026.

Gold Plans

Gold plans have higher monthly premiums but lower deductibles and copays. If you know you will need regular medical care, a Gold plan can actually save you money over the course of a year. Many individuals with chronic conditions are moving toward Gold plans in 2026 to avoid the “sticker shock” of high deductibles.

Platinum Plans

Platinum plans have the highest premiums and the lowest out-of-pocket costs. These are relatively rare in the individual market but are ideal for those who expect significant medical expenses, such as planned surgeries or intensive therapy.

Factors Driving Costs in 2026

To make an informed decision, it is helpful to understand why premiums are shifting this year.

The Impact of GLP-1 Medications

The surge in popularity of drugs like Wegovy and Zepbound has had a profound impact on insurance premiums. Because these medications are expensive and often required for long-term use, insurers have had to adjust their rates to account for the increased pharmacy spend. Some 2026 plans have implemented stricter “prior authorization” requirements for these drugs.

AI and Advanced Diagnostics

2026 has seen a massive rollout of AI-assisted diagnostic tools. While these technologies can lead to earlier detection of diseases, the initial implementation costs are high. Insurers are currently debating how to cover these new “digital health” services, which often leads to higher premiums in the short term.

Labor Shortages in Healthcare

A shortage of nurses and specialized technicians has forced hospitals to raise wages, and these costs are being passed on to insurance companies. When insurers pay more to hospitals, those costs eventually reach the individual consumer in the form of higher monthly premiums.

Critical Deadlines for 2026 Coverage

Timing is everything when it comes to health insurance. Missing a deadline could leave you without coverage for an entire year unless you experience a qualifying life event (such as marriage, having a child, or losing other coverage).

- November 1, 2025: Open enrollment began in most states.

- December 15, 2025: The deadline for coverage starting January 1, 2026.

- January 15, 2026: The final day of open enrollment in most states. Plans selected now will begin coverage on February 1, 2026.

- State-Specific Extensions: States like California, New Jersey, and New York often extend their deadlines until January 31, 2026. It is vital to check your specific state exchange for exact dates.

Strategic Tips for Choosing Your 2026 Plan

As an expert in the field, I recommend the following steps to ensure you get the best value.

1. Analyze Your 2025 Usage

Look back at your medical bills from the past year. Did you hit your deductible? How much did you spend on prescriptions? If you spent very little, a Bronze plan might be a smart way to save on premiums in 2026. If you exceeded your out-of-pocket maximum, a Gold or Platinum plan is likely a better investment.

2. Verify Your Doctors

Networks change every year. Just because your doctor was in-network with a specific Cigna plan in 2025 does not mean they will be in 2026. Always use the “Find a Doctor” tool on the insurer’s website before finalizing your enrollment.

3. Check the Drug Formulary

If you take specific medications, check the plan’s “formulary” (the list of covered drugs). Medications can move between tiers (e.g., moving from a $10 copay to a $50 copay) or even be dropped from coverage entirely.

4. Consider a Health Savings Account (HSA)

If you choose a high-deductible health plan (HDHP), usually a Bronze or Silver tier, you may be eligible for an HSA. This allows you to set aside pre-tax money to pay for medical expenses. In 2026, the contribution limits for HSAs have increased, providing a powerful tax-advantaged way to save for future healthcare needs.

Future Outlook: Healthcare Beyond 2026

Looking ahead, we expect to see even more personalization in health insurance. Wearable technology integration is likely to become a standard feature, with insurers offering premium discounts based on real-time health data like heart rate and daily steps. Furthermore, the push for “Value-Based Care,” where doctors are paid based on patient outcomes rather than the number of tests performed, will continue to reshape how plans are designed.

By staying informed and carefully comparing your options during this open enrollment period, you can find a 2026 health insurance plan that provides both financial security and high-quality care.