The landscape of modern healthcare is changing at a pace we have never seen before. While medical advancements are helping people survive conditions that were once considered fatal, the financial toll of these treatments is reaching record highs. As we navigate the complexities of 2025, many individuals are asking a vital question: Is critical illness insurance truly worth the investment? This guide provides an in-depth analysis of the current market, the rising costs of care, and whether this supplemental coverage fits into your long-term financial strategy.

- The Reality of Healthcare Costs

- What Exactly is Critical Illness Insurance?

- Why the Demand is Surging

- Analyzing the Coverage: What is Usually Included?

- The Big Three: Cancer, Heart Attack, and Stroke

- Neurological and Degenerative Conditions

- Expanded 2025 Benefits

- Critical Illness vs. Disability Insurance: Do You Need Both?

- The Cost-Benefit Analysis: Is It Worth the Premium?

- Strategic Financial Planning

- How to Choose the Right Policy

- 1. Review the List of Covered Conditions

- 2. Check for Survival Periods

- 3. Evaluate the Payout Structure

- 4. Consider Portability

- The Impact of Inflation on Medical Care

- Real-World Scenario: The 50,000-Dollar Difference

- Common Exclusions to Watch For

- The Future of Supplemental Health Protection

- Final Verdict: Is It Worth It?

The Reality of Healthcare Costs

Recent data from the 2025 Global Medical Trends Survey indicates that medical costs are projected to rise by an average of 10.4 percent globally this year. In North America specifically, the trend is expected to hit 8.7 percent, driven by the increasing cost of specialty pharmaceuticals and new medical technologies. For the average family, these numbers are not just statistics; they represent a growing gap between what standard health insurance covers and the actual cost of staying alive and healthy during a crisis.

Health insurance is designed to pay your doctors and hospitals. It manages the direct medical bills. However, it does nothing to address the secondary financial shockwaves of a major diagnosis. When a primary earner is diagnosed with a severe condition, the bills for the mortgage, groceries, utilities, and childcare do not stop. In fact, they often increase due to travel for treatment or the need for specialized home care. This is where the concept of a financial safety net becomes essential.

What Exactly is Critical Illness Insurance?

Critical illness insurance is a type of supplemental policy that pays out a tax-free lump sum if you are diagnosed with a specific condition listed in your contract. Unlike traditional health insurance, which pays providers based on services rendered, this benefit goes directly into your pocket. You have total autonomy over how to spend the money. You could use it to pay off your mortgage, cover your health insurance deductible, or even take an extended leave of absence from work to focus entirely on your recovery.

Typically, these policies cover a core group of life-altering events:

- Invasive cancer

- Heart attack (myocardial infarction)

- Stroke

- Major organ transplant

- Kidney failure

- Paralysis

In 2025, many providers have expanded their definitions to include conditions like Alzheimer’s disease, multiple sclerosis, and even severe cases of mental health disorders, reflecting the shifting needs of a modern workforce.

Why the Demand is Surging

The global critical illness insurance market is estimated to reach 445.49 billion dollars in 2025. This surge is largely due to the “survival paradox.” We are better at surviving major illnesses than ever before, but survival is expensive. For example, the American Heart Association reports that the total cost of cardiovascular disease in the United States is expected to triple by 2050. Even today, the average cost of an inpatient hospital stay for a heart event can exceed 21,000 dollars.

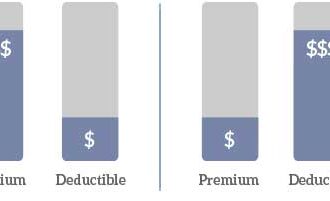

Furthermore, the rise of high-deductible health plans has left many people underinsured. Even with a “good” employer-sponsored plan, an individual might face an out-of-pocket maximum of 9,000 dollars or more. For a household living paycheck to paycheck, a 9,000-dollar bill combined with a loss of income is a recipe for bankruptcy. Statistics from 2025 show that nearly 44 percent of adults find it difficult to afford their healthcare costs, and about 30 percent have skipped necessary care due to the price tag.

Analyzing the Coverage: What is Usually Included?

When you sign up for a policy, you are essentially buying protection against a specific list of medical “triggers.” It is vital to understand that not every illness is a “critical” illness in the eyes of an insurer.

The Big Three: Cancer, Heart Attack, and Stroke

These three conditions account for the vast majority of claims. For cancer, most policies require the diagnosis to be “invasive,” meaning it has spread beyond its point of origin. Some “carcinoma in situ” or early-stage skin cancers may only trigger a partial payout or no payout at all. In 2025, as early detection improves, it is more important than ever to read the fine print regarding “stage zero” or “stage one” diagnoses.

Neurological and Degenerative Conditions

As our population ages, the inclusion of neurological disorders has become a major selling point. Conditions such as Parkinson’s disease and Amyotrophic Lateral Sclerosis (ALS) are now commonly found in comprehensive plans. These illnesses often require years of expensive care and home modifications, making the lump sum from a critical illness policy a vital resource for long-term stability.

Expanded 2025 Benefits

Some of the latest policies in 2025 now include “wellness benefits.” These are small annual payouts (often between 50 and 100 dollars) provided simply for undergoing routine screenings like a mammogram or a colonoscopy. This encourages early detection and provides a small return on your premium even if you never get sick.

Critical Illness vs. Disability Insurance: Do You Need Both?

A common point of confusion is the difference between disability insurance and critical illness insurance. While they both provide financial protection during illness, they serve very different functions.

Disability Insurance: The Income Replacer

Disability insurance is designed to replace a portion of your paycheck (usually 60 to 70 percent) if you are unable to work. It is paid out monthly and continues for as long as you are disabled or until you reach retirement age. It is a long-term solution for sustaining your lifestyle.

Critical Illness Insurance: The Immediate Liquidity

Critical illness insurance is a one-time injection of cash. It does not care if you can still work. If you are diagnosed with a covered heart attack on Monday and are back at your desk on Friday, the policy still pays the full benefit. This makes it ideal for covering the immediate, “lumpy” expenses that hit right after a diagnosis: deductibles, experimental treatments not covered by insurance, or the cost of a spouse taking time off work to be with you in the hospital.

In 2025, financial advisors often recommend a “layered” approach. Using disability insurance to cover the monthly mortgage and critical illness insurance to handle the immediate medical debt or specialized equipment is often the most robust strategy for high earners.

The Cost-Benefit Analysis: Is It Worth the Premium?

To determine if the insurance is worth it, you must look at the cost relative to your existing “buffer.”

When It Is Worth It

- High Deductible Plans: If your health insurance has a high out-of-pocket maximum, a critical illness policy can act as a bridge to cover that gap.

- Limited Savings: If you do not have at least six months of living expenses saved in an emergency fund, the financial hit of a major illness could be catastrophic.

- Family History: While genetics aren’t everything, a strong family history of cancer or heart disease increases the statistical likelihood that you might need to make a claim.

- Sole Breadwinners: If your family relies entirely on your income, the added security of a lump sum payout provides immense peace of mind.

When It Might Not Be Worth It

- Robust Emergency Fund: If you already have 50,000 to 100,000 dollars in liquid savings, you may be “self-insured.” The cost of the premiums over 20 years might outweigh the benefit of the payout.

- Comprehensive Work Benefits: Some high-end executive packages include both short-term disability and generous “illness leave” policies that make supplemental insurance redundant.

- Older Age and High Premiums: Premiums rise significantly as you age. If you are seeking a policy for the first time in your 60s, the cost might be prohibitive compared to the potential benefit.

Strategic Financial Planning

Integrating critical illness insurance into a 2025 financial plan involves looking at the tax implications. In many jurisdictions, if you pay the premiums with post-tax dollars, the lump sum payout is 100 percent tax-free. This is a massive advantage. If you receive a 50,000-dollar payout, you get the full 50,000 dollars. To get the same amount of net cash from a 401k or a standard savings account, you would often have to withdraw significantly more to account for taxes and potential penalties.

Additionally, many companies now offer “return of premium” riders. If you hold the policy for a set number of years (often 15 or 20) and never make a claim, the insurer returns all of your premiums to you. This essentially turns the insurance into a forced savings plan with a death or illness benefit attached. While these riders make the monthly cost higher, they eliminate the “waste” of paying for insurance you never use.

How to Choose the Right Policy

Choosing a policy in 2025 requires more than just looking at the monthly price. You must examine the definitions of the illnesses.

1. Review the List of Covered Conditions

Do not assume “cancer” means all cancer. Look for “definitions” sections in the policy. A good policy will have clear, medical-based criteria for what triggers a payout. In 2025, look for policies that cover at least 30 different conditions.

2. Check for Survival Periods

Most policies have a “survival period,” usually 14 to 30 days. This means you must survive for that length of time after the diagnosis to receive the payout. If a policy has a 90-day survival period, it is much less valuable.

3. Evaluate the Payout Structure

Some policies pay 100 percent for major conditions and 25 percent for “lesser” conditions (like a mild stroke or early-stage cancer). Ensure the “partial” payouts do not cancel the rest of your coverage. A “multiple-claim” policy is the gold standard in 2025, allowing you to claim for a heart attack and then, years later, claim for an unrelated cancer diagnosis.

4. Consider Portability

If you get your coverage through work, check if you can take it with you if you leave the company. “Portable” policies are highly desirable in today’s volatile job market.

The Impact of Inflation on Medical Care

One of the biggest factors making critical illness insurance worth it in 2025 is the “hidden inflation” in healthcare. While the general Consumer Price Index (CPI) might fluctuate, medical inflation almost always outpaces it. The cost of hospital labor, advanced imaging, and robotic surgery continues to climb.

According to data from PwC’s Health Research Institute, the “medical cost trend” is expected to remain high through 2026. This means that a 20,000-dollar “emergency fund” saved in 2020 might only have the purchasing power of 12,000 dollars in a 2025 hospital setting. Critical illness insurance allows you to select a benefit amount that keeps pace with these rising costs.

Real-World Scenario: The 50,000-Dollar Difference

Consider a 40-year-old professional named Sarah. She has a standard PPO health insurance plan with a 5,000-dollar deductible and a 10,000-dollar out-of-pocket maximum. She is diagnosed with Stage II breast cancer.

Without Critical Illness Insurance:

- Sarah pays 10,000 dollars in direct medical costs (her out-of-pocket max).

- She takes three months of unpaid leave, losing 24,000 dollars in income.

- She spends 3,000 dollars on travel to a specialist hospital and childcare.

- Total Financial Hit: 37,000 dollars.

With a 50,000-Dollar Critical Illness Policy:

- Sarah receives 50,000 dollars tax-free upon diagnosis.

- She pays her 10,000-dollar medical bills.

- She replaces her 24,000-dollar lost income.

- She pays for her travel and childcare.

- Result: Sarah has 13,000 dollars left over to pay for a recovery retreat or to put toward her mortgage, allowing her to focus entirely on health without the stress of debt.

In this scenario, which is very common in 2025, the insurance transformed a potential financial crisis into a manageable situation.

Common Exclusions to Watch For

No insurance policy is perfect, and critical illness is no exception. In 2025, insurers are becoming more specific about exclusions:

- Pre-existing Conditions: If you have already had a heart attack, you likely cannot get coverage for a second one, or your premiums will be extremely high.

- Self-Inflicted Injury: Illnesses resulting from drug abuse or chronic alcoholism are typically excluded.

- Waiting Periods: Most policies have a 60-to-90-day waiting period at the very start. If you are diagnosed within the first two months of buying the policy, it will not pay out. This prevents people from buying insurance only after they suspect they are sick.

The Future of Supplemental Health Protection

As we look toward 2026 and beyond, we expect to see more “lifestyle-integrated” policies. These might use data from wearable devices to offer premium discounts to those who maintain a healthy cardiovascular profile or a high level of physical activity. This trend toward “precision insurance” is already beginning in late 2025, making these policies more affordable for those who take proactive steps toward their health.

Furthermore, the integration of telehealth benefits within critical illness policies is rising. Some insurers now provide immediate access to “Second Opinion” services from world-renowned medical centers as part of the policy. This can be as valuable as the cash payout, ensuring you have the right diagnosis and treatment plan from the start.

Final Verdict: Is It Worth It?

For the majority of people in 2025, critical illness insurance is a highly valuable component of a modern financial plan. While it is not a replacement for comprehensive health insurance or disability insurance, it fills a specific and dangerous gap. In an era where medical costs are rising by double digits and high-deductible plans are the norm, having a source of immediate, tax-free liquidity can be the difference between a smooth recovery and a decade of medical debt.

If you have a family, a mortgage, or a high-deductible health plan, the peace of mind offered by a well-chosen policy is likely worth the monthly premium. However, the key is to buy early while you are healthy to lock in lower rates and ensure you have the widest range of coverage possible.

Sources

- WTW Global Medical Trends 2025 Report: https://www.wtwco.com/en-ke/insights/2024/10/2025-global-medical-trends-survey

- KFF Health Tracking Poll on Medical Debt: https://www.kff.org/health-costs/americans-challenges-with-health-care-costs/

- PwC Medical Cost Trend Analysis: https://www.pwc.com/us/en/industries/health-industries/library/behind-the-numbers.html

- American Heart Association 2025 Statistics: https://www.heart.org/en/about-us/heart-and-stroke-statistics

- Precedence Research on Insurance Market Growth: https://www.precedenceresearch.com/critical-illness-insurance-market