Navigating the world of medical coverage can feel like learning a new language, especially when you are a young adult entering the workforce or transitioning off a family plan. As we look toward the landscape of 2026, the stakes have never been higher. Legislative shifts, rising medical costs, and new technological advancements are reshaping how individuals under 30 access healthcare.

- The 2026 Health Insurance Landscape: A Year of Change

- Key Enrollment Dates for 2026

- The Age 26 Milestone: Transitioning to Your Own Plan

- Understanding Plan Types: HMO vs PPO vs EPO

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- The Metal Tiers: Bronze, Silver, Gold, and Platinum

- Catastrophic Health Plans: A Budget Friendly Option

- The Role of Health Savings Accounts (HSAs)

- Mental Health and Telehealth Coverage in 2026

- Freelancers and Gig Workers: Securing Independent Coverage

- Common Mistakes to Avoid

- The Future of Healthcare: What to Watch for Beyond 2026

- Final Steps for Your 2026 Enrollment

This guide provides a comprehensive breakdown of everything you need to know about securing health insurance in 2026. Whether you are a recent college graduate, a freelancer in the gig economy, or an employee at a growing startup, understanding these nuances is essential for protecting both your physical health and your financial future.

The 2026 Health Insurance Landscape: A Year of Change

The year 2026 marks a significant turning point for health insurance in the United States. One of the most critical factors influencing the market is the expiration of enhanced premium tax credits that were established during the pandemic and extended through 2025. Without further legislative action, many individuals will see a noticeable shift in their monthly premiums.

For young adults, this means that the “sticker price” of plans on the federal and state marketplaces might appear higher than in previous years. However, this does not mean that affordable options have disappeared. It simply means that strategic shopping and a deep understanding of available subsidies are more important than ever.

In addition to subsidy changes, medical inflation is projected to rise by approximately 9 percent to 10 percent in North America during 2026. This is driven by the increased cost of specialized pharmaceuticals, such as GLP-1 medications for metabolic health, and the integration of advanced diagnostic technologies. Being proactive about your coverage today can prevent unexpected financial burdens tomorrow.

Key Enrollment Dates for 2026

If you are looking for coverage that begins in 2026, you must keep a close eye on the Open Enrollment Period. For most states using the federal marketplace, the timeline is as follows:

- November 1, 2025: Open Enrollment begins. This is the first day you can sign up for, renew, or change your health insurance plan for the 2026 calendar year.

- December 15, 2025: This is the deadline to enroll if you want your coverage to begin on January 1, 2026.

- January 15, 2026: Open Enrollment officially ends. If you miss this date, you generally cannot sign up for a plan unless you qualify for a Special Enrollment Period.

- February 1, 2026: Coverage begins for those who enrolled between December 16 and January 15.

Mark these dates on your calendar. Missing the window could mean going an entire year without coverage, which exposes you to significant financial risk in the event of an accident or illness.

The Age 26 Milestone: Transitioning to Your Own Plan

For many young adults, the most significant change comes on their 26th birthday. Under current laws, children can stay on their parents’ health insurance plans until they turn 26. While this is a helpful safety net, the transition can be jarring if you are unprepared.

The Special Enrollment Period (SEP)

Turning 26 is considered a “Qualifying Life Event.” This means you are eligible for a Special Enrollment Period, allowing you to sign up for health insurance outside of the standard Open Enrollment window. Usually, you have 60 days before and 60 days after your 26th birthday to select a new plan.

Planning Ahead

Do not wait until your birthday to start researching. Look at your current coverage and determine what you value most. Is it a low monthly premium? Or do you prefer a low deductible because you see a specialist regularly? Comparing your parents’ plan to potential new options will help you maintain continuity of care.

Understanding Plan Types: HMO vs PPO vs EPO

When you start browsing for plans, you will encounter various acronyms that describe how the insurance network functions. Choosing the right one depends on your lifestyle and health needs.

Health Maintenance Organization (HMO)

HMO plans generally require you to choose a Primary Care Physician (PCP) who coordinates all of your care. If you need to see a specialist, you typically need a referral from your PCP. These plans are often more affordable, but they limit you to a specific network of providers. If you see an out of network doctor, the insurance might not cover any of the costs.

Preferred Provider Organization (PPO)

PPO plans offer the most flexibility. You do not need a referral to see a specialist, and you can see doctors outside of the network, though it will cost more than seeing an in network provider. These plans are ideal for young adults who travel frequently or have specific doctors they want to keep.

Exclusive Provider Organization (EPO)

EPO plans are a hybrid. Like an HMO, they generally do not cover out of network care except in emergencies. However, like a PPO, you usually do not need a referral to see a specialist within the network. These are often a middle ground in terms of cost.

The Metal Tiers: Bronze, Silver, Gold, and Platinum

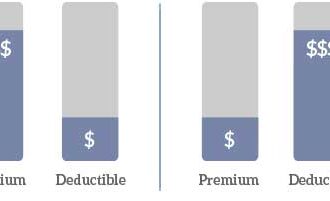

Marketplace plans are categorized by “metal tiers” to help you understand how costs are split between you and the insurance company. It is important to remember that these tiers do not reflect the quality of medical care, but rather the financial structure of the plan.

Bronze Plans

Bronze plans have the lowest monthly premiums but the highest out of pocket costs when you receive care. These are often the best choice for healthy young adults who rarely visit the doctor and want protection primarily for “worst case” scenarios.

Silver Plans

Silver plans sit in the middle. They have moderate premiums and moderate deductibles. One unique feature of Silver plans is that they are the only tier eligible for “cost sharing reductions.” If your income falls within a certain range, choosing a Silver plan can significantly lower your out of pocket maximums and copays.

Gold and Platinum Plans

These plans have high monthly premiums but very low out of pocket costs. If you have a chronic condition, take expensive medications, or plan on having a major medical procedure in 2026, these tiers might actually save you money in the long run.

Catastrophic Health Plans: A Budget Friendly Option

For adults under 30 (or those with a hardship exemption), Catastrophic plans are an available option. These plans have very low premiums and very high deductibles. They are designed to protect you from massive medical bills resulting from a serious injury or illness.

In 2026, Catastrophic plans include three primary care visits per year at no cost and certain preventive services before you hit your deductible. While they offer peace of mind, ensure you have enough savings to cover the high deductible if an emergency does occur.

The Role of Health Savings Accounts (HSAs)

If you choose a High Deductible Health Plan (HDHP), you may be eligible for a Health Savings Account (HSA). An HSA is a powerful financial tool that allows you to set aside pre tax money to pay for qualified medical expenses.

Benefits of an HSA:

- Tax Savings: Contributions are tax deductible, and the money grows tax free.

- Portability: The money in your HSA belongs to you forever. It does not disappear at the end of the year like a Flexible Spending Account (FSA).

- Investment Potential: Many HSA providers allow you to invest your balance in the stock market once you reach a certain threshold, turning your healthcare fund into a secondary retirement account.

For a young person, starting an HSA in 2026 could be one of the smartest financial moves you make.

Mental Health and Telehealth Coverage in 2026

As we move into 2026, the demand for mental health services continues to grow. Fortunately, most modern health plans are required to cover mental health and substance use disorder services as “essential health benefits.”

Telehealth has also become a standard feature. Many insurers now offer $0 or low cost virtual visits for both primary care and mental health counseling. When comparing plans for 2026, check the “Telehealth” section of the Summary of Benefits to see if your preferred therapy platform is included.

Freelancers and Gig Workers: Securing Independent Coverage

The “freelance revolution” means more young adults are self employed than ever before. If you do not have access to an employer sponsored plan, you have several avenues:

- The Health Insurance Marketplace: This is the most common route. You may qualify for subsidies based on your estimated annual income.

- Professional Organizations: Some groups, like the Freelancers Union, offer access to group insurance rates for their members.

- Private Insurance: You can purchase plans directly from insurance companies, though these often lack the subsidies found on the marketplace.

Remember that as a self employed individual, your health insurance premiums may be 100 percent tax deductible on your federal income tax return.

Common Mistakes to Avoid

- Choosing Based Only on Premium: A plan with a $50 monthly premium might seem like a steal, but if it has a $9,000 deductible and you end up needing a $5,000 procedure, you are responsible for the full cost. Always calculate your “total cost” (Premium x 12 + Expected Out of Pocket Costs).

- Ignoring the Provider Network: Before signing up, check if your favorite doctor or local hospital is in network. Using an out of network provider can lead to massive “balance billing.”

- Forgetting Prescription Coverage: If you take regular medication, use the marketplace search tool to enter your specific drugs. Plans vary wildly in how they tier and cover different medications.

The Future of Healthcare: What to Watch for Beyond 2026

While we are focused on 2026, the healthcare industry is evolving rapidly. Artificial Intelligence (AI) is being integrated into diagnostic tools, which may lead to more personalized insurance premiums based on preventative health data. Additionally, there is a growing movement toward “Value Based Care,” where providers are rewarded for patient outcomes rather than the number of tests performed.

Final Steps for Your 2026 Enrollment

- Gather your documents: You will need your tax returns, social security number, and current income information.

- Review your 2025 medical spending: How much did you actually spend on healthcare last year? Use this as a baseline.

- Compare at least three plans: Do not just renew your current plan automatically. New providers may have entered your area for 2026 with better rates.

- Check for subsidies: Even if you did not qualify last year, changes in income or federal guidelines could make you eligible now.