In the modern business landscape, the movement of goods and services is the heartbeat of the economy. Whether you are a solo contractor with a single pickup truck or a logistics giant managing a fleet of hundreds, the risks associated with being on the road are substantial. As we navigate through 2025, the complexities of protecting your business assets have evolved. From the integration of artificial intelligence in claims processing to the rise of electric vehicle fleets, staying informed is no longer optional. This guide provides a comprehensive breakdown of everything you need to know about commercial vehicle insurance today.

- Understanding the Core of Commercial Auto Policies

- Deep Dive into 2025 Coverage Options

- Bodily Injury and Property Damage Liability

- Physical Damage Coverage

- Hired and Non-Owned Auto (HNOA)

- Cargo and Inland Marine Insurance

- The Financial Landscape: What Does Business Insurance Cost in 2025?

- Emerging Technology: Telematics and the Future of Fleets

- Regulatory Shifts and Compliance Standards for the New Year

- Strategic Ways to Reduce Your Business Insurance Premiums

- Navigating the Modern Claims Experience

- Choosing the Right Carrier in 2025

- The Role of Electric Vehicles in Commercial Portfolios

- Looking Ahead: Preparing for 2026

Understanding the Core of Commercial Auto Policies

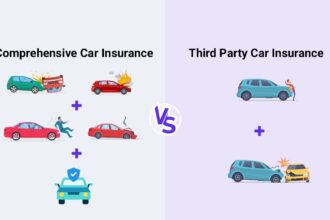

Commercial vehicle insurance is a specialized policy designed to cover vehicles used for business purposes. While it may seem similar to your personal auto policy on the surface, the underlying structure and risk assessments are vastly different. These policies are crafted to handle the higher liability limits and unique exposures that come with commercial activity.

For instance, a delivery van makes dozens of stops in high-traffic areas daily, increasing the probability of a minor collision. A heavy-duty construction truck carries massive weight that can cause catastrophic damage in the event of a brake failure. Commercial insurance accounts for these variables, providing a safety net that personal policies simply cannot match.

Why Your Personal Policy is Not Enough

One of the most common mistakes small business owners make is assuming their personal auto insurance will cover them while they are working. This is a dangerous misconception. Most personal policies explicitly exclude coverage for any vehicle used primarily for business or for transporting goods and people for a fee.

If you are involved in an accident while delivering a product or driving to a client site, and you only have a personal policy, your insurer may deny the claim entirely. This leaves your business exposed to lawsuits, medical bills, and repair costs that could easily lead to bankruptcy. Commercial policies bridge this gap by offering higher liability limits, typically starting at $500,000 or $1,000,000, which is significantly more than the standard $50,000 or $100,000 found in personal plans.

Deep Dive into 2025 Coverage Options

The insurance market in 2025 has moved toward more modular and customizable coverage options. Businesses can now tailor their protection to fit their specific operational risks.

Bodily Injury and Property Damage Liability

Liability remains the foundation of any commercial policy. Bodily injury coverage pays for the medical expenses and legal fees if your driver is at fault for an accident that injures someone else. Property damage coverage handles the repairs to other vehicles or structures. In 2025, we are seeing a trend toward “Nuclear Verdicts,” where jury awards in commercial trucking accidents are reaching record highs. As a result, many experts now recommend liability limits of at least $2,000,000 for medium-sized operations.

Physical Damage Coverage

This section is divided into two parts: Collision and Comprehensive.

- Collision coverage pays for damages to your own vehicle regardless of who is at fault.

- Comprehensive coverage protects against non-collision events such as theft, vandalism, fire, or weather-related damage. With the increasing frequency of extreme weather events in late 2025, comprehensive coverage has become a priority for fleets parked in outdoor lots.

Hired and Non-Owned Auto (HNOA)

This is a critical addition for businesses that do not own vehicles but have employees who use their personal cars for work errands. It also covers vehicles that the business rents. HNOA provides liability protection for the company if an employee gets into an accident while on a “company clock” using a non-company vehicle.

Cargo and Inland Marine Insurance

For those in the logistics and transport sector, protecting the goods being carried is as important as protecting the vehicle itself. Cargo insurance covers the loss or damage of freight during transit. In 2025, new regulations have increased the transparency requirements for cargo protection, making it essential to have detailed records of what you are hauling to ensure full reimbursement in the event of a loss.

The Financial Landscape: What Does Business Insurance Cost in 2025?

The cost of insuring a commercial vehicle is influenced by a multitude of factors, ranging from the type of vehicle to the location of your operations. According to recent data from late 2025, the average cost for a small business commercial auto policy is approximately $1,762 per year, or about $147 per month. However, these figures can vary wildly by industry.

Average Monthly Costs by Sector

| Industry | Average Monthly Premium |

| General Contractors | $215 |

| Business Consulting/Sales | $226 |

| Towing Services | $534 |

| For-Hire Specialty Trucks | $736 |

| Long-Haul Transport Trucks | $1,125 |

Regional Price Variations

Geography plays a massive role in your premium calculations. States with high population density and high litigation rates typically see much higher costs. For example, a business in California might pay an average of $1,400 per month for a small fleet, while a similar business in North Carolina might only pay $560.

In late 2025, insurers are also factoring in local infrastructure quality. Areas with deteriorating roads or high accident rates at specific intersections are seeing “micro-targeted” rate increases. This makes it vital for business owners to shop around and use brokers who understand the local market dynamics.

Emerging Technology: Telematics and the Future of Fleets

We are currently in the midst of a technological revolution in the insurance industry. Telematics, the use of GPS and onboard diagnostics to track driving behavior, has seen an 88% adoption rate among commercial fleets as of December 2025.

How Telematics Impacts Your Rates

Insurers are no longer relying solely on historical data to set prices. By sharing real-time data on braking habits, speed, cornering, and idling, businesses can prove they are low-risk. This shift toward usage-based insurance (UBI) allows proactive fleet managers to secure discounts of up to 25% on their premiums.

Expert Insight: Data from SambaSafety’s 2025 report indicates that only 30% of fleets currently share their data with insurers, despite 88% having the technology. This “trust gap” represents a massive missed opportunity for businesses to lower their overhead costs.

Artificial Intelligence in Claims

The days of waiting weeks for an adjuster to inspect a damaged vehicle are fading. AI-powered platforms can now analyze photos of an accident scene and provide a repair estimate within minutes. This not only speeds up the claims process but also reduces the administrative costs for the insurer, which can eventually lead to more competitive pricing for the policyholder.

Regulatory Shifts and Compliance Standards for the New Year

As we move into 2026, several new regulatory frameworks introduced in 2025 are becoming fully enforceable. These changes are aimed at increasing safety and accountability on the roads.

Increased Liability Minimums

Several states have updated their minimum liability requirements for commercial carriers. These changes were prompted by the rising costs of medical care and vehicle repairs. Businesses that fail to update their policies to meet these new state minimums risk heavy fines and the suspension of their operating licenses.

Stricter Driver Qualification Files (DQF)

Federal and state agencies are now requiring more rigorous documentation of driver training and history. This includes mandatory entry-level training pathways for commercial drivers. Insurers are following suit by requiring businesses to provide proof of ongoing driver safety education before they will issue or renew a policy.

Strategic Ways to Reduce Your Business Insurance Premiums

While rates have stabilized somewhat in late 2025 compared to the double-digit hikes of previous years, insurance remains a significant expense. Fortunately, there are several levers you can pull to manage these costs.

Invest in a Safety Culture

The most effective way to lower insurance costs is to avoid accidents. Implementing a formal safety program that includes regular vehicle inspections and defensive driving workshops can make your business much more attractive to underwriters. Many insurers now offer “safety credits” for businesses that can demonstrate a commitment to risk management.

Adjust Your Deductibles

If your business has a healthy cash flow, consider increasing your deductible. By taking on more of the initial risk yourself, you can significantly lower your monthly or annual premium payments. For example, moving from a $500 deductible to a $2,500 deductible can sometimes reduce premiums by 15% to 20%.

Bundle Your Policies

Most major carriers, such as State Farm, Progressive, and Travelers, offer substantial discounts if you bundle your commercial auto insurance with other business policies like General Liability or a Business Owner’s Policy (BOP). This not only saves money but also simplifies your administrative work by having a single point of contact for all your insurance needs.

Navigating the Modern Claims Experience

If the worst happens and one of your vehicles is involved in an accident, the steps you take in the first hour are critical. The claims environment in 2025 is highly data-driven.

- Immediate Documentation: Drivers should use company apps to take high-resolution photos of the damage, the license plates of other vehicles, and the surrounding road conditions.

- Telematics Snapshot: Ensure your telematics provider preserves the data from the 30 seconds before and after the impact. This data is often the best defense against fraudulent claims.

- Prompt Reporting: Notify your insurance agent as soon as possible. Delaying a report can lead to complications, especially if there are potential bodily injury claims from the other party.

Modern insurers are using “predictive modeling” to identify which claims might escalate into major legal battles. By being transparent and providing all necessary data upfront, you can help your insurer settle the claim quickly and fairly, minimizing the long-term impact on your premiums.

Choosing the Right Carrier in 2025

Not all insurance companies are created equal. Some specialize in heavy trucking, while others focus on small delivery fleets or contractor vans.

- Progressive: Known for its user-friendly interface and competitive rates for small businesses and independent contractors.

- State Farm: Offers a vast network of local agents and strong financial stability, often providing the most competitive rates for “liability-only” coverage.

- The Hartford: A top choice for businesses that need specialized coverage for high-value equipment and sophisticated risk management tools.

- Travelers: Excellent for larger fleets that require complex international coverage or specialized cargo protections.

The Role of Electric Vehicles in Commercial Portfolios

As of late 2025, more businesses are transitioning to electric vehicle (EV) fleets to meet sustainability goals and reduce fuel costs. However, insuring these vehicles brings a new set of challenges.

The upfront repair costs for EVs are currently about 14% higher than their internal combustion counterparts. This is due to the specialized nature of battery repairs and the relative scarcity of qualified technicians. While you may save on fuel, you should prepare for slightly higher premiums for your EV units until the repair infrastructure becomes more widespread.

Looking Ahead: Preparing for 2026

The commercial insurance market is currently in a “stabilization phase.” After the turbulence of 2023 and 2024, rates are now increasing at a more moderate pace of about 10% annually, compared to 15% in previous cycles. For well-managed businesses with clean safety records, there are even opportunities for rate decreases.

The key to success in this environment is being proactive. Don’t wait for your renewal notice to start thinking about your insurance. Engage with your broker early, review your safety protocols, and embrace the technology that allows you to prove your value as a low-risk client.

Summary of Key Points for Business Owners:

- Verify that your liability limits are sufficient for today’s legal environment.

- Utilize telematics to gather data and negotiate better rates.

- Implement a rigorous driver safety program to build a positive risk profile.

- Keep detailed records to comply with the 2025 regulatory updates.

- Shop around and consider bundling policies for maximum savings.