The healthcare landscape is undergoing a massive transformation as we head into 2026. Navigating the world of medical coverage has never been more complex, yet the stakes have never been higher for your physical and financial well-being. With medical costs projected to rise globally by approximately 10.3 percent this year, finding the right plan requires more than just a cursory glance at monthly premiums. It demands a strategic understanding of policy structures, network limitations, and the shifting regulatory environment that defines the 2026 market.

- The Current State of Health Insurance: Live Updates for December 2025

- The Major Shift in 2026: The Expiration of Enhanced Subsidies

- Understanding Policy Structures: HMO, PPO, EPO, and POS

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- Decoding the Metal Tiers: Bronze, Silver, Gold, and Platinum

- Bronze Plans: Low Premium, High Deductible

- Silver Plans: The Balanced Middle

- Gold and Platinum Plans: High Premium, Low Deductible

- The Strategic Advantage of the Health Savings Account (HSA)

- Evaluating Network Breadth and Provider Access

- Managing Prescription Drug Costs in 2026

- The Role of Telehealth and AI in Modern Plans

- Special Considerations for the Self-Employed and Small Business Owners

- 7-Step Checklist for Choosing Your 2026 Policy

- Final Thoughts on 2026 Coverage

This guide provides a deep dive into everything you need to know to secure the best coverage for yourself, your family, or your business. We will explore the nuances of plan types, the impact of expiring federal subsidies, and the innovative technological features that are becoming standard in modern policies.

The Current State of Health Insurance: Live Updates for December 2025

As of today, December 24, 2025, we are in the final stretch of the annual Open Enrollment Period for 2026 coverage. This is a critical time for anyone seeking individual or family plans through the federal marketplace or state exchanges.

If you are looking for coverage that begins on February 1, 2026, you must act quickly. In the vast majority of states, the deadline to enroll is January 15, 2026. While the window for a January 1 start date closed on December 15, the current window remains the last opportunity for most Americans to secure a plan without a qualifying life event like marriage, the birth of a child, or a job change.

It is also important to note that certain states offer extended deadlines. Residents in California, New Jersey, New York, Rhode Island, and the District of Columbia generally have until January 31, 2026, to finalize their selections. Conversely, Idaho concluded its enrollment on December 15, 2025. If you missed these dates, you may need to look into short-term health insurance options or wait for a Special Enrollment Period.

The Major Shift in 2026: The Expiration of Enhanced Subsidies

The most significant factor influencing plan choice in 2026 is the expiration of the enhanced premium tax credits that were a hallmark of the last few years. These subsidies, which made coverage significantly more affordable for millions of households, are scheduled to revert to their pre-2021 levels unless last-minute legislative action is taken.

For many enrollees, this means that even if you stay with the same plan you had in 2025, your monthly out-of-pocket costs could increase. On average, premiums for the lowest-cost plans on the marketplace are projected to rise, with some estimates suggesting an increase of $13 to $50 per month depending on income levels and location.

When comparing plans this year, it is vital to calculate your costs based on the updated subsidy calculations. Do not rely on last year’s numbers. Use the official calculators on sites like HealthCare.gov to get an accurate picture of your net premium after credits.

Understanding Policy Structures: HMO, PPO, EPO, and POS

Choosing the right type of plan is often a trade-off between cost and flexibility. In 2026, the distinctions between these structures have become even more pronounced as insurers try to manage rising costs by tightening provider networks.

Health Maintenance Organization (HMO)

HMOs remain the most budget-friendly option but come with the most restrictions. You are typically required to choose a Primary Care Physician (PCP) who acts as a gatekeeper for your care. To see a specialist, you must obtain a referral from your PCP. Except for emergencies, out-of-network care is generally not covered.

Preferred Provider Organization (PPO)

PPOs offer the greatest amount of freedom. You do not need a referral to see a specialist, and you have the option to see doctors outside of the plan’s network, though you will pay a higher portion of the cost. PPOs usually come with higher monthly premiums and higher deductibles.

Exclusive Provider Organization (EPO)

An EPO is a hybrid of an HMO and a PPO. Like an HMO, it usually does not cover out-of-network care except for emergencies. However, like a PPO, you typically do not need a referral to see an in-network specialist. These are becoming increasingly popular in 2026 as a middle-ground solution.

Point of Service (POS)

POS plans require you to have a PCP and get referrals for specialists, similar to an HMO. However, they do allow you to go out-of-network for a higher cost, similar to a PPO. These plans are less common today but are still available in certain regional markets.

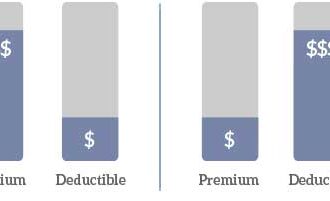

Decoding the Metal Tiers: Bronze, Silver, Gold, and Platinum

The “Metal Levels” on the marketplace indicate how you and your insurance company share costs. They do not reflect the quality of medical care you receive, but rather the financial structure of the plan.

Bronze Plans: Low Premium, High Deductible

Bronze plans have the lowest monthly premiums but the highest costs when you need care. These are best for individuals who are generally healthy and want protection against major medical catastrophes. In 2026, many Bronze plans have been redesigned to qualify as High-Deductible Health Plans (HDHPs), allowing you to open a Health Savings Account (HSA).

Silver Plans: The Balanced Middle

Silver plans offer moderate premiums and moderate costs for care. They are particularly important because they are the only plans eligible for “cost-sharing reductions” if your income falls within certain limits. These reductions lower your deductible and out-of-pocket maximum, sometimes making a Silver plan more cost-effective than a Gold plan.

Gold and Platinum Plans: High Premium, Low Deductible

These plans are designed for people who expect to use their insurance frequently. If you have a chronic condition, take expensive prescriptions, or are planning a surgery in 2026, the higher monthly premium of a Gold or Platinum plan is often offset by the significantly lower costs at the doctor’s office or hospital.

The Strategic Advantage of the Health Savings Account (HSA)

For 2026, the Health Savings Account remains one of the most powerful financial tools available. To contribute to an HSA, you must be enrolled in an HSA-qualified High-Deductible Health Plan.

The benefits are threefold:

- Contributions are 100 percent tax-deductible (or pre-tax through an employer).

- The money grows tax-free within the account.

- Withdrawals for qualified medical expenses are tax-free.

A new development for 2026 in several states is the expanded list of services that can be paid for using HSA funds without hitting your deductible first. This includes more preventive services and, in some cases, monthly fees for Direct Primary Care (DPC) arrangements. If you are relatively healthy and looking to build a medical nest egg, an HSA-qualified plan should be at the top of your list.

Evaluating Network Breadth and Provider Access

A plan is only as good as the doctors who accept it. In 2026, “narrow networks” have become the norm as a way for insurers to keep premiums low. Before you commit to a policy, you must perform a thorough check of their provider directory.

Do not assume that because a doctor was in-network last year, they remain in-network this year. Contracts between hospital systems and insurance carriers are frequently renegotiated. Use the insurer’s online search tool to verify that your preferred primary doctor, specialists, and local hospitals are included.

Furthermore, check the “quality ratings” provided by the National Committee for Quality Assurance (NCQA). These ratings give you insight into how well the plan manages patient care, handles claims, and maintains member satisfaction.

Managing Prescription Drug Costs in 2026

Prescription drug prices are a major driver of healthcare inflation this year. Each insurance plan has a “formulary,” which is a list of drugs it covers and the cost-sharing associated with them. Formularies are typically divided into tiers:

- Tier 1: Preferred generic drugs (lowest cost).

- Tier 2: Non-preferred generics and preferred brand drugs.

- Tier 3: Non-preferred brand drugs.

- Tier 4: Specialty drugs (highest cost, often including biologics).

In 2026, we are seeing a significant increase in the usage of GLP-1 medications for weight loss and diabetes management. If you require these or other high-cost medications, you must check the formulary before choosing a plan. Some plans may require “prior authorization” or “step therapy,” where you must try a less expensive drug before the insurer will cover the more expensive one.

The Role of Telehealth and AI in Modern Plans

Technological integration is no longer a luxury: it is a core component of 2026 health insurance policies. Many plans now offer $0 copays for virtual visits. Beyond simple video calls, we are seeing the rise of AI-driven diagnostic tools and wearable integration.

Some insurers now offer “wellness credits” or premium discounts if you share data from your fitness tracker, showing that you are meeting certain activity goals. Additionally, AI chatbots are being used to help members navigate their benefits, find the lowest-cost providers for specific procedures, and even provide mental health support through cognitive behavioral therapy apps. When comparing plans, look for these “value-added” benefits which can save you both time and money.

Special Considerations for the Self-Employed and Small Business Owners

If you are a freelancer, gig worker, or small business owner, 2026 brings unique challenges. Without a large employer to subsidize your premiums, you are more vulnerable to the rising costs of the individual market.

Consider looking into Individual Coverage Health Reimbursement Arrangements (ICHRAs). These allow employers to give employees a tax-free monthly allowance to buy their own health insurance on the individual market. This provides flexibility for the employee and cost predictability for the business owner.

For the self-employed, remember that your health insurance premiums are typically 100 percent tax-deductible, which can significantly lower your overall tax burden at the end of the year.

7-Step Checklist for Choosing Your 2026 Policy

To ensure you make the best choice, follow this systematic approach:

- Estimate Your Total Healthcare Usage: Review your medical visits and pharmacy receipts from the past two years to project your needs for 2026.

- Verify Your Doctors and Hospitals: Use the insurer’s current 2026 directory to confirm your preferred providers are in-network.

- Compare the “Total Cost of Ownership”: Do not just look at the premium. Calculate the annual cost of premiums plus your expected out-of-pocket expenses for the year.

- Check the Prescription Formulary: Ensure your regular medications are covered and note which tier they fall under.

- Evaluate HSA Eligibility: Determine if a high-deductible plan with an HSA is financially advantageous for your tax situation.

- Look for Telehealth and Wellness Perks: Identify which plans offer free virtual care or incentives for healthy living.

- Finalize Before the Deadline: For most, the window closes on January 15, 2026. Do not wait until the last minute, as websites often experience heavy traffic and technical issues.

Final Thoughts on 2026 Coverage

Choosing a health insurance policy is one of the most important financial decisions you will make this year. While the 2026 market presents challenges in the form of higher costs and expiring subsidies, it also offers more choices and better technology than ever before. By taking the time to understand the fine print and comparing plans beyond the monthly price tag, you can find a policy that provides both the medical security you need and the financial stability you deserve.