The landscape of the automotive world has shifted significantly as we navigate through 2026. For young drivers, the excitement of getting behind the wheel is often met with the sobering reality of modern financial requirements. Navigating the world of auto insurance as a teenager or a young adult in their early twenties requires a blend of savvy research, technological adaptation, and strategic planning. This comprehensive guide explores the current trends, projected costs, and expert tips for securing the best possible coverage in today’s market.

- The State of Auto Insurance in 2026

- Average Cost of Auto Insurance for Young Drivers in 2026

- Why Insurance Costs More for Gen Z and Gen Alpha

- Strategies to Lower Your Premium in 2026

- Embrace Telematics and Usage-Based Insurance (UBI)

- The Good Student Discount

- Defensive Driving Courses

- Choosing the Right Vehicle

- Understanding Coverage Types: What Do You Actually Need?

- The Role of Parental Policies

- Best Insurance Companies for Young Drivers in 2026

- Handling Accidents and Claims in 2026

- Future Outlook: Beyond 2026

The State of Auto Insurance in 2026

As we move deeper into the decade, the insurance industry has undergone a digital transformation. We are no longer just looking at age and zip codes; we are looking at real-time data and artificial intelligence. In 2026, many insurance carriers have fully integrated agentic AI into their underwriting processes. This means that instead of static risk tables, premiums are often calculated using dynamic models that react to live inputs and real-time driving behaviors.

Current market analysis indicates that while the massive double-digit rate hikes of the early 2020s have stabilized, costs are still on a gradual upward trajectory. For 2026, national averages suggest a modest but consistent increase of approximately 3% to 4% in premium costs. This rise is primarily driven by the increasing complexity of vehicle technology. Even a minor fender bender in a 2026 model often involves recalibrating expensive sensors, cameras, and lidar modules that are essential for modern safety systems.

Average Cost of Auto Insurance for Young Drivers in 2026

Understanding the numbers is the first step in budgeting for your first policy. While rates vary wildly based on individual circumstances, several industry leaders have provided baseline figures for 2026.

Costs Based on Age

Age remains one of the most influential factors in determining your premium. Statistically, younger drivers are more prone to accidents, and insurance companies price their risk accordingly.

- 16-Year-Old Drivers: The highest risk category. On average, a 16-year-old can expect to pay around $457 per month for full coverage. For male drivers, this figure can often exceed $475, while female drivers may see rates closer to $435.

- 18-Year-Old Drivers: By the time a driver reaches 18, rates typically begin a slight descent. The average monthly cost for full coverage at this age sits at approximately $330.

- 21-Year-Old Drivers: This is a significant milestone for many. At 21, the national average drops further to about $163 per month for full coverage.

- 25-Year-Old Drivers: This is often the age where premiums “bottom out” for the young driver category. The average 25-year-old pays roughly $119 per month, which is much closer to the overall national average for adults.

Regional Variations

Where you park your car at night has a massive impact on your wallet. In 2026, states like Delaware and Nevada remain among the most expensive for young drivers, with annual rates often exceeding $5,000 for full coverage. Conversely, states like Maine, New Hampshire, and Alaska offer some of the most competitive rates, sometimes falling under $1,500 per year for similar coverage levels.

Why Insurance Costs More for Gen Z and Gen Alpha

The demographic currently entering the driving population consists of Gen Z and the oldest members of Gen Alpha. While these generations are highly tech-savvy, they face unique challenges that drive insurance costs higher than previous generations.

Increased Vehicle Mass

Modern vehicles, particularly electric vehicles (EVs) and larger SUVs, have increased in weight. In 2026, the average new vehicle weight is projected to exceed 4,600 lbs. Heavier vehicles possess more kinetic energy during collisions, leading to more severe damage and higher medical costs. Insurance companies have adjusted their formulas to account for this “weight penalty.”

The Cost of Repairing “Smart” Cars

The software-defined vehicles of 2026 are essentially computers on wheels. A standard bumper on a 2026 sedan isn’t just a piece of plastic; it contains ultrasonic sensors and radar units. Replacing these components requires specialized labor and software recalibration, which has caused repair inflation to outpace general inflation.

Distracted Driving in a Digital Age

Despite advanced driver assistance systems (ADAS), distracted driving remains a primary cause of accidents among youth. The integration of smartphones into every aspect of life creates a constant stream of notifications that are a major concern for insurers.

Strategies to Lower Your Premium in 2026

While the baseline costs are high, there are more tools available today than ever before to help young drivers reduce their expenses.

Embrace Telematics and Usage-Based Insurance (UBI)

In 2026, telematics is no longer a niche option; it is becoming the standard. By using a smartphone app or a small device installed in your car, you allow the insurance company to track your actual driving habits. Factors such as hard braking, rapid acceleration, speeding, and late-night driving are monitored.

Safe drivers can see discounts of 10% to 30% through these programs. For a young driver paying $4,000 a year, a 25% discount through a telematics program means $1,000 back in their pocket. This is perhaps the most effective way for a young person to prove they are an outlier to the “high-risk” statistics.

The Good Student Discount

Academic performance is still a highly regarded metric by insurers. High school and college students who maintain at least a B average (3.0 GPA) can often qualify for a “Good Student Discount.” Insurers have found a strong correlation between the discipline required for good grades and responsible behavior on the road.

Defensive Driving Courses

Completing an accredited defensive driving or driver education course can provide an immediate reduction in premiums. In 2026, many of these courses are available in highly interactive, VR-based formats that are more engaging for young learners and provide better skill retention.

Choosing the Right Vehicle

The type of car you drive is one of the few factors you have total control over. In 2026, the data shows that small SUVs and small pickups are generally the cheapest vehicles for young people to insure.

Top Recommended Vehicles for Low Premiums in 2026

- Subaru Crosstrek: Consistently ranked as one of the most affordable vehicles to insure for young drivers, with rates roughly 17% below the national average.

- Honda CR-V: A favorite for its high safety ratings and moderate repair costs.

- Toyota RAV4: Known for its reliability and favorable risk assessment by most major carriers.

- Volkswagen Polo (and similar compacts): While these have smaller engines, their high safety scores make them attractive to insurers.

Interestingly, while electric vehicles are environmentally friendly, they can be more expensive for young drivers to insure due to the high cost of battery replacement and specialized repair requirements. A Tesla Model 3, for example, can cost significantly more to insure than a comparable gasoline-powered compact SUV.

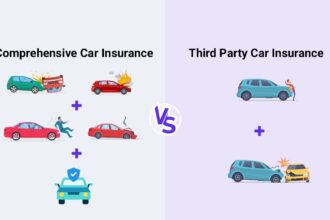

Understanding Coverage Types: What Do You Actually Need?

Navigating the different layers of an insurance policy is essential to ensure you are neither under-insured nor over-paying for unnecessary extras.

Liability Coverage

This is the legal minimum required in almost every state. It covers damage you cause to others, including their vehicle and medical bills. While it is the cheapest option, it provides zero protection for your own car.

Collision and Comprehensive

These are often bundled together and are usually required if you have a car loan or lease. Collision covers damage to your car from an accident, while comprehensive covers non-collision events like theft, fire, or weather damage. For a young driver with a car worth more than $5,000, these are highly recommended.

Uninsured/Underinsured Motorist Coverage

In 2026, a significant number of drivers still take the risk of driving without insurance. If one of these drivers hits you, this coverage ensures your medical and repair bills are paid. It is an often-overlooked but vital component of a robust policy.

The Role of Parental Policies

One of the most effective ways for a teenager to save money is to be added to their parents’ existing policy. Multi-car and multi-policy discounts are substantial. While the parents’ premium will certainly increase, the total cost is almost always lower than it would be if the young driver took out a standalone policy.

However, it is important to be transparent with your insurer. “Rate evasion,” such as failing to list a teen driver who is a regular operator of a household vehicle, can lead to denied claims or policy cancellation.

Best Insurance Companies for Young Drivers in 2026

Based on recent satisfaction surveys and rate comparisons, several companies stand out for their treatment of the youth market.

- State Farm: Frequently cited as the cheapest national provider for young drivers. Their “Drive Safe & Save” program is one of the most robust telematics options available.

- Erie Insurance: While only available in a limited number of states, Erie consistently offers some of the lowest rates for those with clean driving records.

- Geico: Known for its user-friendly mobile app and competitive pricing for 18-to-24-year-olds.

- USAA: If you or a family member are military or veterans, USAA is almost always the top choice for both price and service.

Handling Accidents and Claims in 2026

Accidents happen, especially when you are learning the ropes. In 2026, the claims process has become almost entirely digital. Most major insurers now allow you to file a claim by taking photos and videos through their app. AI-powered tools then analyze the damage to provide an initial estimate within minutes.

For a young driver, an at-fault accident can stay on your record for three to five years, leading to a significant “surcharge” on your premium. This is why many experts recommend “Accident Forgiveness” coverage if your insurer offers it. This prevents your first accident from hiking your rates.

Future Outlook: Beyond 2026

As we look toward 2027 and 2028, we expect to see even more granular pricing. The concept of “pay-per-mile” insurance will likely gain more traction for students who live on campus and rarely drive. Furthermore, as autonomous features become more standard, we may see a shift in liability away from the driver and toward the vehicle manufacturer in certain scenarios.